01. Our client

Our client is a leading financial services company operating in Central Africa. The client, part of a consortium managing seven banks, aimed to provide a next-generation Internet banking platform that was scalable, secure, and could adapt to their changing needs. The solution had to support a range of Core Banking Systems (CBS) and offer a white-label architecture that could be easily customized and deployed across its banking ecosystem.

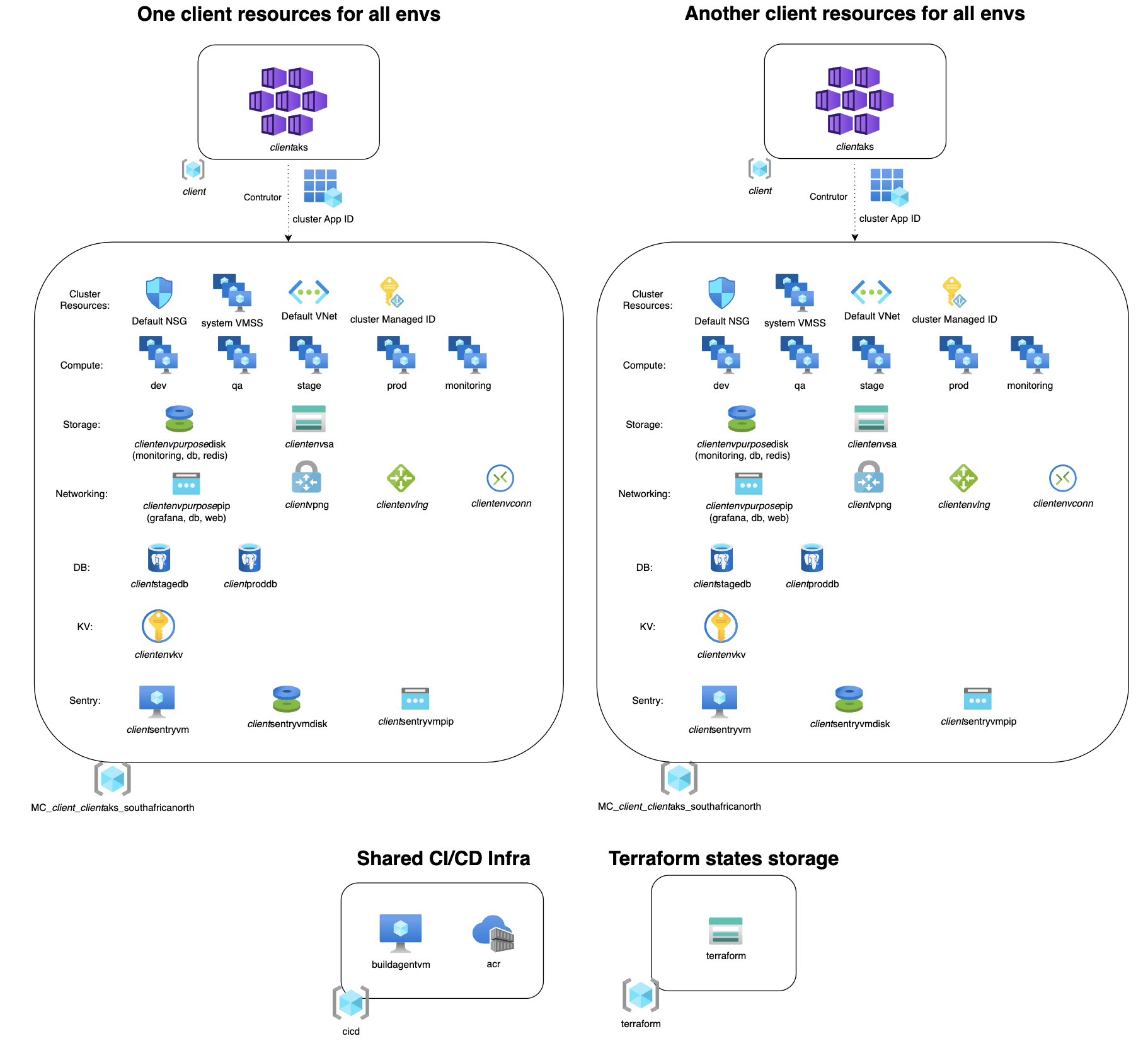

Realizing that they required a high-performing, scalable, and secure infrastructure, the client joined efforts with Teamvoy to create a hybrid cloud architecture that could satisfy these aspects: security, cost, and performance.

02. Challenge

Developing a sophisticated Internet banking platform posed several architectural challenges:

Hybrid Deployment Requirements:

- Combine on-premises infrastructure for critical operations with public cloud solutions for non-essential functions.

- Ensure seamless communication between the two environments while maintaining cost efficiency.

Flexibility and Scalability:

- Create a scalable architecture that could meet variable user demand and enable new banks or regions to be onboarded without issue.

- Design modular architecture to enable updates and enhancements without disrupting the platform.

CBS Integration:

- Develop a robust API gateway and middleware to support diverse CBS systems across the group.

- Provide real-time data synchronization and compatibility with legacy systems.

Security and Compliance:

- Implement advanced data encryption, multi-factor authentication, and compliance with regional banking regulations.

- Establish a disaster recovery and redundancy strategy to ensure uninterrupted service.

Customizing and White-Labeling:

- Allow banks to quickly customize the platform branding, user experience, and features without sacrificing security or performance.

03. Cooperation

Teamvoy partnered closely with the client to deliver a cutting-edge Internet banking platform tailored to their needs.

Starting with an in-depth discovery phase, we worked hand-in-hand to define the hybrid architecture and ensure compatibility with diverse Core Banking Systems (CBS). Agile development practices enabled seamless feedback integration, while our Lift & Shift strategy ensured a smooth migration from legacy systems with minimal disruption. We designed and deployed a scalable hybrid cloud solution, balancing on-premises security with cloud flexibility. Close communication and collaboration ensured the platform met the client’s goals, providing a secure, customizable, and future-ready solution.

04. Solution delivered

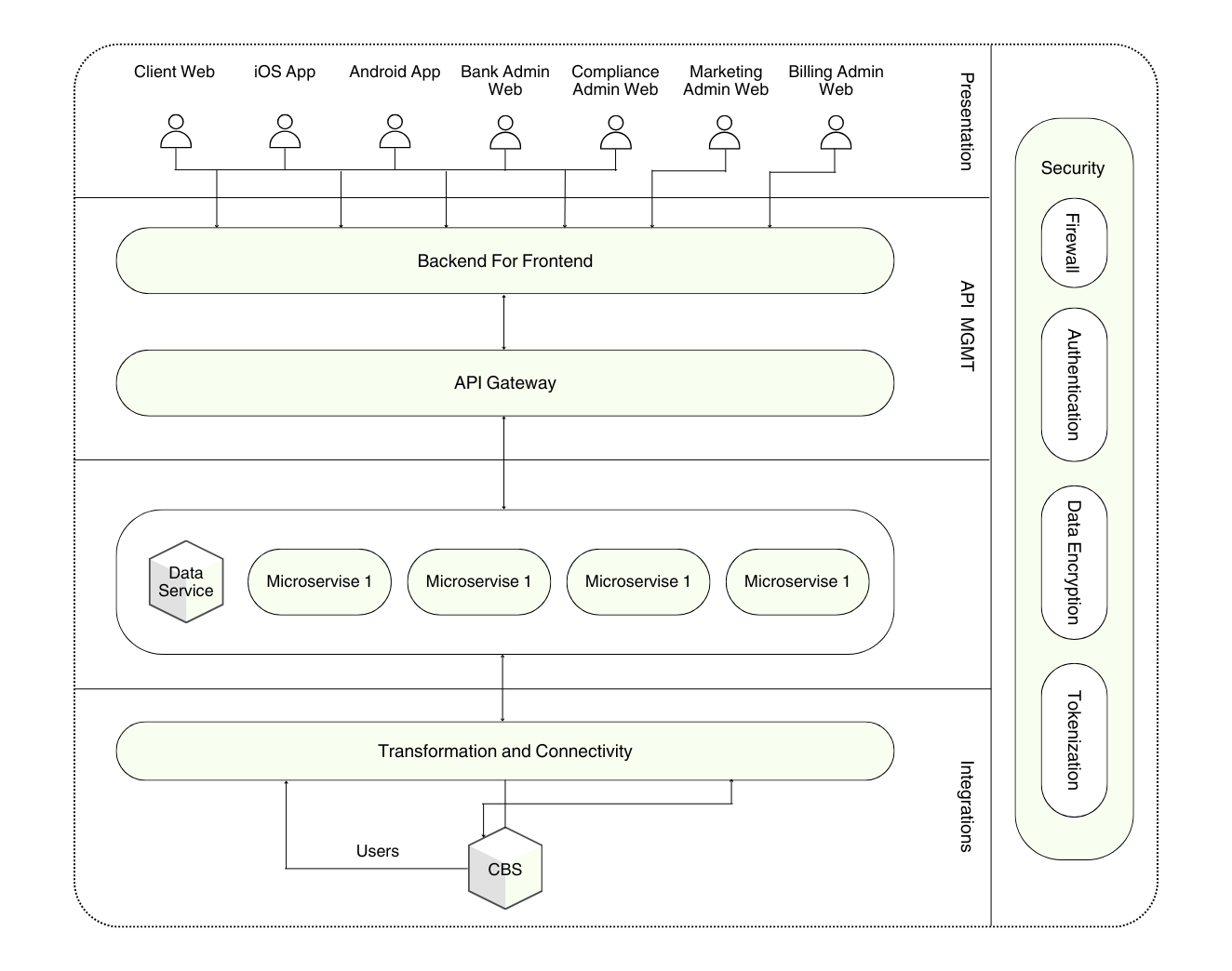

To address the complex requirements of building a next-generation Internet banking platform, Teamvoy delivered a sophisticated hybrid cloud architecture.

This solution was designed to ensure scalability, security, and flexibility while accommodating the diverse needs of the client and its partner banks. The project’s emphasis on modularity and adaptability enabled the platform to seamlessly integrate with various Core Banking Systems (CBS) and support a wide range of banking operations.

The hybrid deployment model was at the platform’s core, combining both on-premises infrastructure and public cloud service.

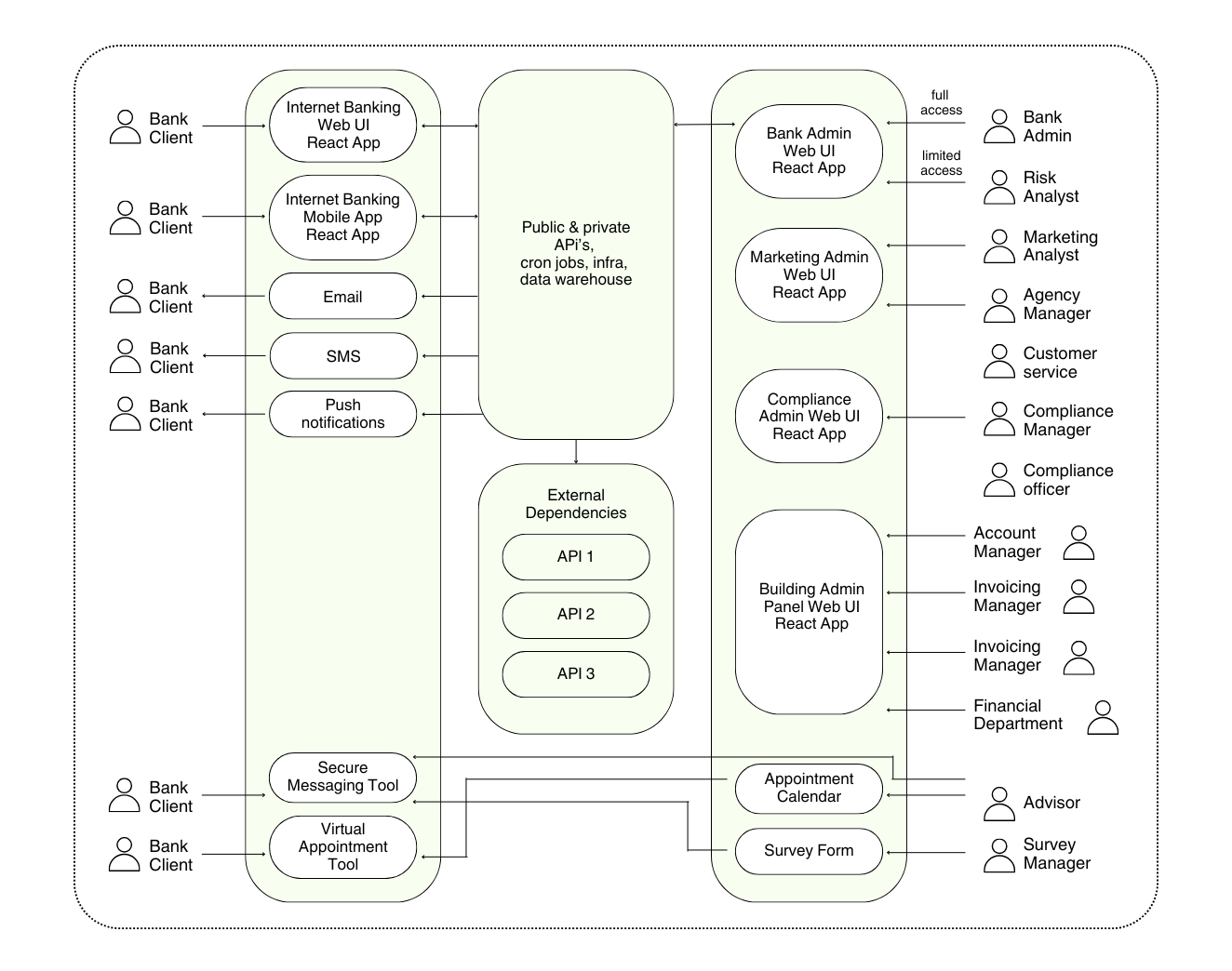

With VMware ESXi hypervisor running on BareMetal servers, critical operations were performed over Linux-based VMs known for their efficient isolation. This solution offered end-to-end control over sensitive components and minimal latency by preventing risks from intermediaries. Components not critical to the infrastructure, like customer success tools and video conferencing, were deployed on public cloud platforms to reduce costs and make maintenance easier.

Containerization and orchestration technologies like Docker enabled workloads to be easily transitioned and managed across on-prem and cloud environments.

The Lift & Shift approach was crucial in transitioning legacy systems to the new hybrid infrastructure.

By replicating the existing environment with minimal modifications, the project achieved a fast and seamless migration to the cloud. This strategy preserved the integrity of legacy applications while enabling the client to harness the benefits of modern cloud technologies. Over time, the platform’s infrastructure was optimized to better use cloud-native features, allowing for increased performance and cost efficiency.

Another key pillar of the project was integration with numerous CBS systems. Teamvoy developed a robust API Gateway – the primary interface for communication between the platform and external systems that should be secure and effective. This gateway enabled real-time data synchronization and supported seamless integration with third-party services, including payment processors and regulatory reporting tools.

API adapters were introduced to address each partner bank’s unique requirements, simplifying the integration process regardless of CBS’s underlying technology.

The BFF layer ensured that data retrieval and service delivery were optimized for the user interface.

This dedicated backend streamlined communication between the platform’s presentation layer and the underlying services, delivering a responsive and engaging user experience. The presentation layer itself was designed with inclusivity in mind, featuring accessibility enhancements such as text-to-speech functionality, adjustable font sizes, and intuitive navigation.

To support ongoing scalability and flexibility, Teamvoy adopted a microservices architecture, which divided the system into self-contained modules responsible for specific functions.

This modular design enabled rapid development and deployment of new features and the ability to scale individual components independently based on demand. Elastic scaling mechanisms ensured that the platform could handle fluctuating user loads without compromising performance. The development process was meticulously planned to ensure high-quality code delivery and streamlined workflows.

A branching strategy was implemented, with branches structured for specific purposes, such as feature development, pre-release testing, and production readiness.

Semantic release tools were employed to automate versioning and changelog generation, ensuring consistency and transparency in updates. The continuous integration/continuous deployment (CI/CD) pipeline also included security scanning with tools like Snyk and code quality checks using ESLint and Prettier, reinforcing the platform’s reliability and security.

The client required a white-label platform that could be adept at working with multiple banks.

Therefore, customization and flexibility were the primary focus. In doing so, Teamvoy created a UIKit that enabled partner banks to customize the branding elements, including a theme, logo, user interface components, and more, without having any profound technical knowledge. Modularity ease-of-use allowed banks to only implement features necessary for their particular challenges and financial situations.

Security was integrated into every aspect of the platform’s architecture.

Data was encrypted at rest and in transit using industry-standard protocols such as TLS/SSL. Multi-factor authentication (MFA) enhanced user identity verification, while regular compliance audits and penetration testing ensured adherence to regulatory requirements. The platform also featured a comprehensive disaster recovery strategy, with geographically distributed data centers providing redundancy and failover support. Regular disaster recovery drills and updates ensured the system’s resilience in the face of unexpected events.

By leveraging these advanced architectural and development strategies, Teamvoy delivered a scalable, secure, and future-ready internet banking platform that met the client’s current needs while positioning them for long-term growth and innovation.

06. Info

Client: Under NDA.

Industry: Finance, Banking

Java Development: Java 21

Services: Architecture Design, Hybrid Cloud Deployment, API Development and Integration, Infrastructure Optimization, Security Implementation, Microservices Development, Lift & Shift Migration, Monitoring and Disaster Recovery, DevOps and CI/CD Automation, White-Label Customization Support

Case Study Categories: Banking,

Cloud, Fintech

Application Frameworks: Spring Boot

Data Access and Mapping: Spring Data JPA, Mapstruct

Code Quality and Conciseness: Lombok

Database Management: PostgreSQL 16, Liquibase, Redis

Testing and Test Data Generation: JUnit, WireMock, Testcontainers (PostgreSQL, Redis), Instancio