Home → Case Studies → CardB

01. Challenge

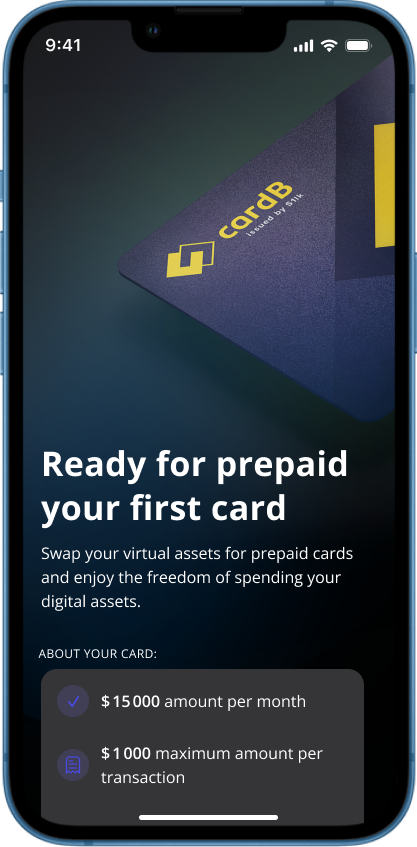

CardB is an innovative solution in the fintech and blockchain area.

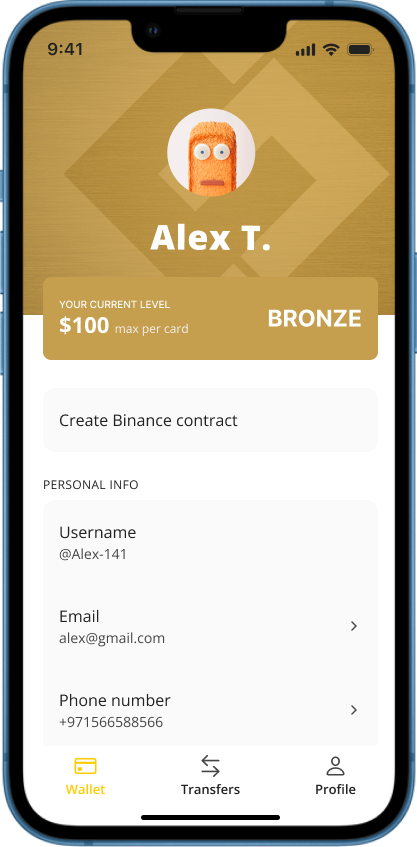

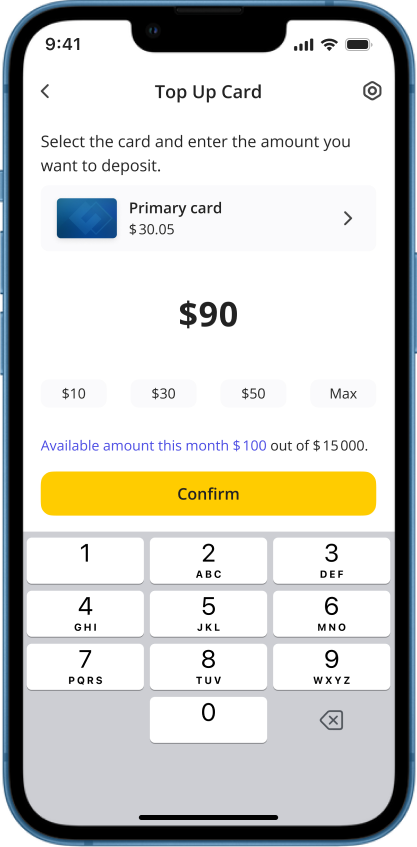

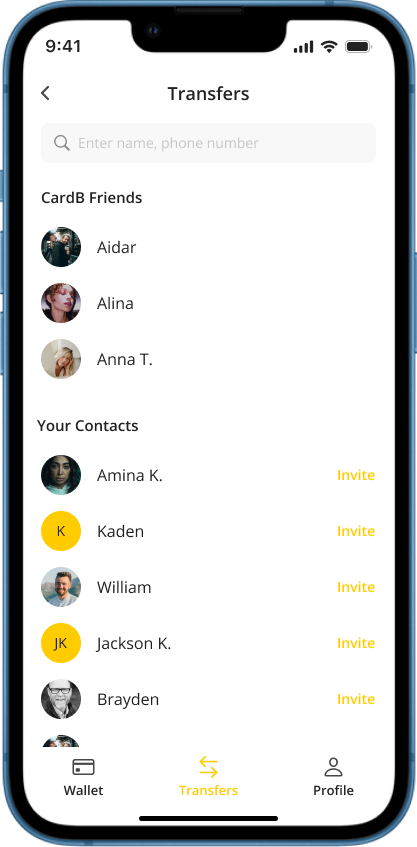

With the CardB crypto card, users can convert their cryptocurrencies and pay immediately in any Shopping Mall or online. You can top up the card using Binance Pay. CardB virtual card can be added to Samsung Pay and Apple Pay.

As a trusted partner and advisor Teamvoy develops and provides Naming, Logo, Design Guide book, Mobile & Web Applications, Merchant items, and a website for CardB.

The main concept and challenge is:

“Digital asset → regular money”

So, our primary objective was to craft a revolutionary tool empowering cryptocurrency enthusiasts to seamlessly integrate digital assets into their daily routines, transforming it into an effortlessly sophisticated experience.

Here are the three most challenging things in the process of developing a strong and reliable fintech solution:

02. Solutions: Branding

How to create solid fintech branding?

03. Solutions: Security & Compliance

Let’s talk about the basis of our choice of the backend stack for CardB, as well as delve into important aspects of building a robust and secure financial solution.

For the backend development, Teamvoy has chosen the following stack: Ruby on Rails with GraphQL

So, why Ruby?

Features of building a reliable financial solution:

- Cloud-based tokenization platform

CardB does not store card data locally but utilizes the best solutions of a payment infrastructure leader in this area. Teamvoy has implemented this solution to ensure the highest level of security. This method prevents potential loss of user data in case of hacker attacks since we only store tokens.

- Azure – Autoscaling & load balancing

Teamvoy chose Azure as a safe cloud platform that is optimal for the needs of CardB from the cloud & geographical perspective. Azure offers services that comply with multiple compliance programs, including ISO 27001:2005.

Auto-scaling & load balancing are used to scale up and distribute incoming traffic across multiple targets automatically.

- PCI DSS

Our commitment to security is underscored by our successful passage through PCI-DSS certifications, ensuring the highest standards of data security

The PCI DSS (Payment Card Industry Data Security Standard) is an information security standard designed to reduce payment card fraud by increasing security controls around cardholder data.

- Global KYC Checks

Utilizing advanced technology, our Know Your Customer (KYC) checks are thorough, efficient, and user-friendly.

- UFX Way4 – Core Banking interface

Teamvoy adopts this data transfer protocol due to its enhanced reliability and structured framework, particularly critical within the financial sector.

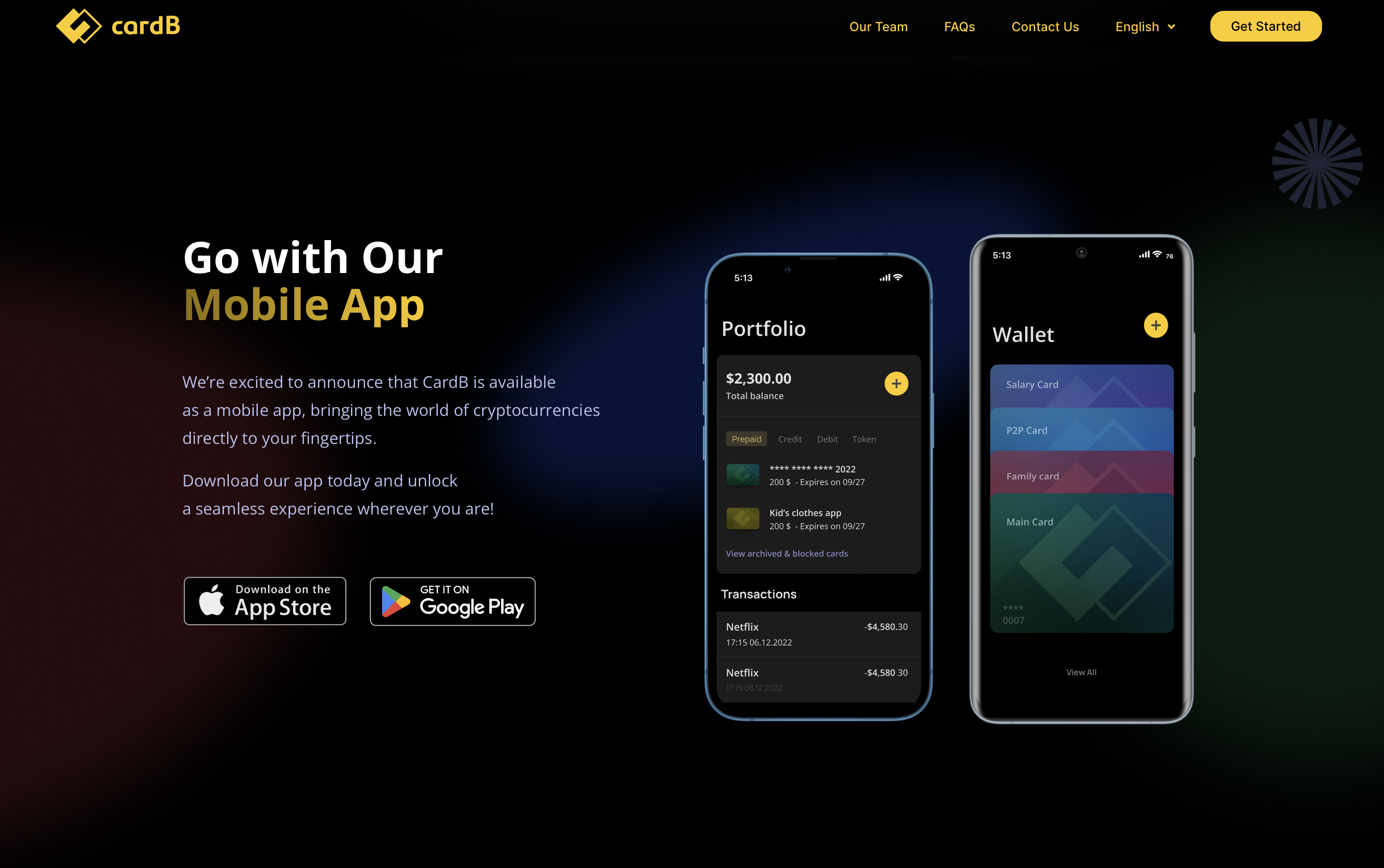

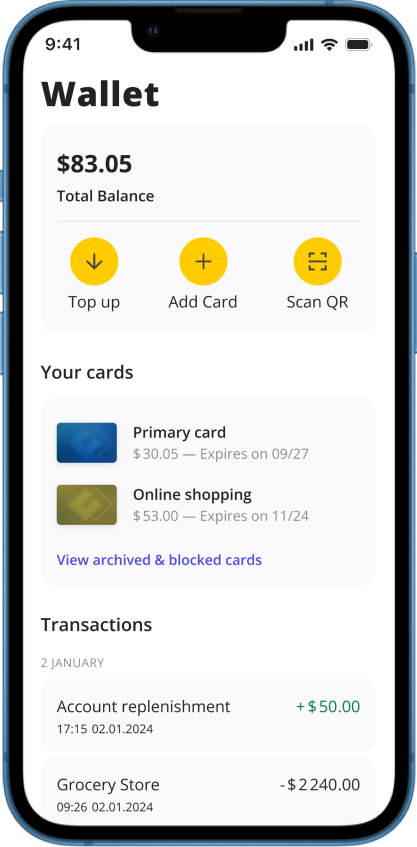

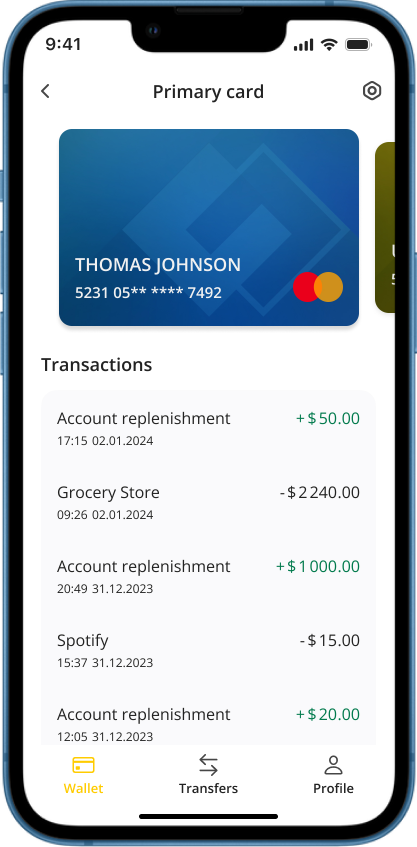

04. Solutions: Cross-platform mobile app

So, why Cross-platform?

- Wide Audience Coverage

Cross-platform applications can be used on different devices, allowing to reach a larger user audience.

- Resource Efficiency

Instead of developing separate versions for each platform, one code can be created to work across all of them.

- Simplified Development Process

Using cross-platform tools and frameworks can streamline development since you don’t have to deal with platform-specific details.

- Third-Party Tools Integrations

Depending on the region or regulatory requirements different tools can be easily and securely integrated into React Native App. Eg. AML/PEP checks for clients

- Ease of Use

Cross-platform applications can provide a consistent user interface across different devices, making it easier for users to transition between them.

React Native & Cross-platform applications:

In our approach to developing cross-platform applications, we leverage React Native.

React Native’s popularity in cross-platform mobile development stems from its incorporation of native components, facilitating high-performance applications that closely mimic native ones. The framework promotes code reusability between iOS and Android, streamlining development and allowing simultaneous implementation of changes or updates. With a robust community, extensive third-party libraries, hot reloading for rapid development, cost-effectiveness through shared code, and consistent updates, React Native emerges as a powerful, user-friendly tool for building top-quality cross-platform mobile applications.

05. Impact

– Onboarded 40000+ users during first 2 months

– Performed 3 marketing launch campaigns

– 10000 new users in 5 hours – the most intense campaign

– The rate of app is 4+ in the Apple App Store

06. Want to know more?

Your roadmap to build fintech excellence begins here.

Have a question or want to discuss a potential collaboration?

Contact us!

Home → Case Studies → CardB